Do you have to have car insurance in Texas? The answer is simple. If you have a driver’s license and drive your own car, you have to have car insurance. Texas car insurance requirements protect you as well as other drivers on the road. If an unlicensed driver causes an accident, you can’t file a claim with their insurance company for compensation for your repairs or injuries. You either have to use your own uninsured motorist coverage or file a lawsuit to recover compensation directly from the at-fault driver. Texas law requires a minimum amount of coverage, so it is illegal to drive without insurance in Texas. Texas drivers who don’t have insurance are subject to harsh penalties.

If you or a loved one was injured in an accident with an uninsured motorist, it’s important to have a competent and experienced auto accident attorney by your side. The San Antonio personal injury attorneys at Janicek Law are ready to support you through every step of this overwhelming process. Navigating life after an accident is a difficult process, especially if anything hinders the insurance claim process (like an at-fault uninsured driver). Our legal team has the knowledge and experience necessary to recover the compensation you deserve after your accident. Call us today at 210-366-4949 to schedule a free consultation with our Texas accident attorneys.

Why is Car Insurance Important?

Purchasing car insurance is an important part of being a responsible Texas driver. By maintaining at least the minimum coverage on your vehicle, you can protect both yourself and other drivers on the road. Vehicle repairs and medical bills after any accident can be extensive. Footing the bill on your own simply isn’t possible when most Americans live paycheck to paycheck. Insurance companies handle this for you. After an accident, you simply have to file a claim with your insurance provider and they take care of the rest for you. When the at-fault driver doesn’t have an insurance provider in Texas, injured victims are limited in the ways they can recover compensation for their injuries.

Types of Auto Insurance in Texas

Car insurance companies offer different tiers of coverage depending on how well-protected you want to be. Liability coverage is the only required insurance in Texas, but insurance companies are required to offer supplemental coverage as well. Insurance coverage can cover everything from basic car repairs to rental cars after a Texas car accident. If you or a loved one have been involved in a Texas car accident, contact an experienced San Antonio car accident lawyer for a free consultation.

Liability Insurance

Liability coverage ensures that you can pay for any accidents you may cause. Liability insurance includes bodily injury liability and property damages. This insurance pays for the other driver’s vehicle repairs, their medical bills, and any passenger’s medical bills.

Collision Coverage

If you lease or finance your car, you are likely required by the lender to have collision coverage. This coverage pays for damage to your car after a collision with another vehicle or a stationary object.

Comprehensive Coverage

Comprehensive coverage is often required by a lender as well. Comprehensive coverage covers damage to your vehicle after non-collision events. This includes theft, vandalism, weather damage, and other acts that are out of your control.

Gap Insurance

Gap insurance helps drivers pay for the remaining balance of their car loan. This prevents people from having to keep making car notes on a vehicle that was totaled in an accident.

Medical Payments Coverage

Medical bills after an accident can add up quickly. Medical benefits help pay for you and your passenger’s injuries after an accident that was not your fault. This insurance coverage can also pay for your injuries if you’re hurt in someone else’s car, in a biking accident, or if you’re hit in a pedestrian accident.

If you’re a pedestrian who’s been injured by a negligent driver, our law firm can help. Contact a San Antonio pedestrian accident lawyer to learn more.

Personal Injury Protection (PIP)

All auto insurance policies in Texas include personal injury protection, or PIP coverage. This insurance coverage is similar to medical payments, but PIP covers more than just medical costs. PIP coverage extends to lost wages and other nonmedical costs. PIP coverage protects drivers regardless of fault.

Rental Car Coverage

Accidents, repairs, and general maintenance can put your car in the shop for an indeterminate amount of time. Rental car coverage can help pay for a car rental while your vehicle is out of commission.

Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage can help protect injured drivers after an uninsured driver causes an accident. If the at-fault driver only has minimum liability coverage, it’s possible that their insurance won’t pay for all of your financial losses. Uninsured/underinsured motorist coverage helps bridge the gap between what the at-fault driver pays for and the true cost of the accident.

Texas Car Insurance Laws

Texas drivers are legally required to have basic insurance coverage on registered vehicles. According to the Texas Department of Motor Vehicles, an estimated 20% of Texas drivers are uninsured. To combat uninsured motorists, Texas law requires drivers to have basic coverage in the event of an accident.

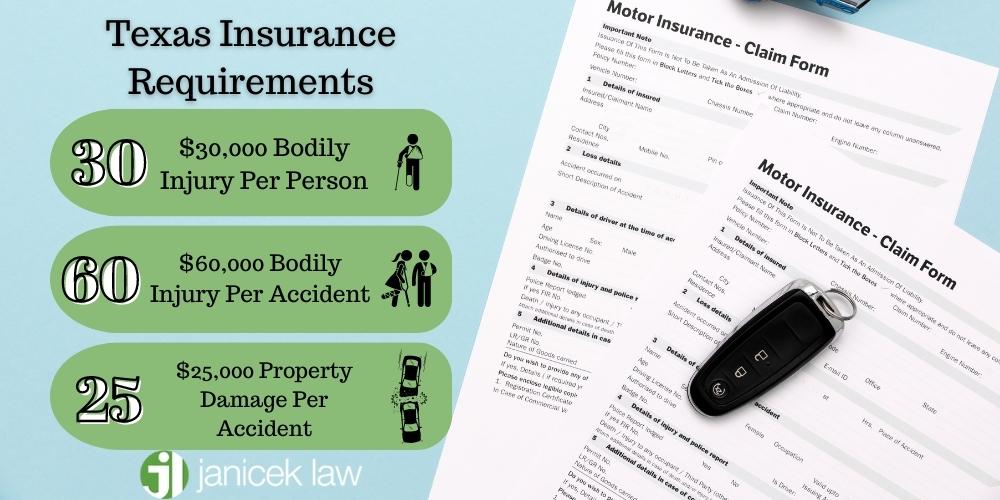

Texas Car Insurance Minimum Requirements

Texas law requires drivers to maintain basic coverage. This is often called the 30/60/25 rule. The minimum car insurance requirements in Texas include:

- $30,000 bodily injury per person

- $60,000 bodily injury coverage per accident

- $25,000 property damage per accident

Do You Have to Have Car Insurance in Texas?

If you are a licensed driver with a registered car, Texas law requires you to maintain minimum coverage on your vehicle. Being caught driving without insurance can range from minor fines to jail time. Driving without insurance also makes you a high-risk driver, which can increase your insurance premiums when you eventually get insurance.

What Happens if I Drive Without Car Insurance in Texas?

Anytime you’re pulled over by law enforcement, you are asked to provide your driver’s license, insurance card, and vehicle registration. Not having these documents in the vehicle with you can result in tickets and fines, even if you only left the documents at home.

The penalties for driving without car insurance in Texas can be severe. In addition to being financially responsible for any accidents you cause, you can be fined, lose your driving privileges, and even lose your vehicle.

Penalties for No Insurance in Texas

Prior to 2019, Texas ran a “Texas Driver Responsibility Program” to dissuade people from driving without insurance. This program imposed an annual $250 charge for three years after driving without insurance. This program has been repealed, but the penalties for driving without insurance are still severe.

Even a first offense can cost you dearly. The fines for a first offense run between $175 and $350. You’ll also be required to file an SR-22 certificate after getting insurance. This certificate is a document that certifies you have at least the minimum coverage insurance. Driving without insurance makes you a risky driver in the eyes of an insurance company, which increases the cost of your insurance premiums. People with an SR-22 certificate pay, on average, $933 more for insurance coverage every year.

Driving without insurance (and getting caught) a second time can result in even more severe consequences. In addition to fines between $350 and $1,000 and the SR-22 certificate, the court could order your vehicle to be impounded. As of 2021, the impound day rate is $21.03. At the end of the day, you could be looking at nearly $5,000 in fines and costs. The punishment for subsequent no-insurance offenses is the same.

Being pulled over and ticketed isn’t the only way uninsured drivers in Texas are punished. At-fault uninsured drivers are subject to harsh penalties as well.

What If I Get Into an Accident in Texas and I Don’t Have Insurance?

Texas law requires drivers to have insurance to prove they are financially capable of paying for any accident they cause. In exchange for monthly premiums, your insurance provider shoulders the financial responsibility for you. Responsible, less risky drivers often get discounts on their insurance rates, while high-risk drivers often see an increase in premiums.

If you don’t have insurance and cause an accident, you have to bear the full financial responsibility for the accident. This includes the medical costs of any injured victims and vehicle repairs–not to mention the cost of your own injuries and repairs. Not having insurance also opens you up to civil litigation. This means that injured victims can sue you for medical costs, lost wages, and even pain and suffering. A civil lawsuit can take every penny from you and bankrupt your family.

In addition to all of this, you may lose your driving privileges. Your license may be suspended after you cause an accident. You can even be sentenced to six months in prison for being uninsured in an accident.

San Antonio Car Accident Attorneys

Getting into a car accident can cause devastating injuries that leave lasting consequences for you and your family. When an uninsured driver causes these catastrophic injuries or wrongful death, recovering compensation for your injuries may seem like a lost hope. At Janicek Law, our San Antonio fatal car accident lawyers and personal injury attorneys can help you fight for compensation with a personal injury claim. Call us today at 210-366-4949 to schedule a free consultation and let our board-certified attorneys start the fight for you.